*Updated March 27, 2020 – On the evening of March 18, 2020, the President signed the Families First Coronavirus Response Act (the “Act”). It will go into effect on April 1, 2020*, and remain in effect until December 31, 2020. This is a change from the original expected effective date of April 2, 2020*. While the Act covers several programs, those most relevant to employers are included in this blog post.

Emergency Family and Medical Leave Expansion

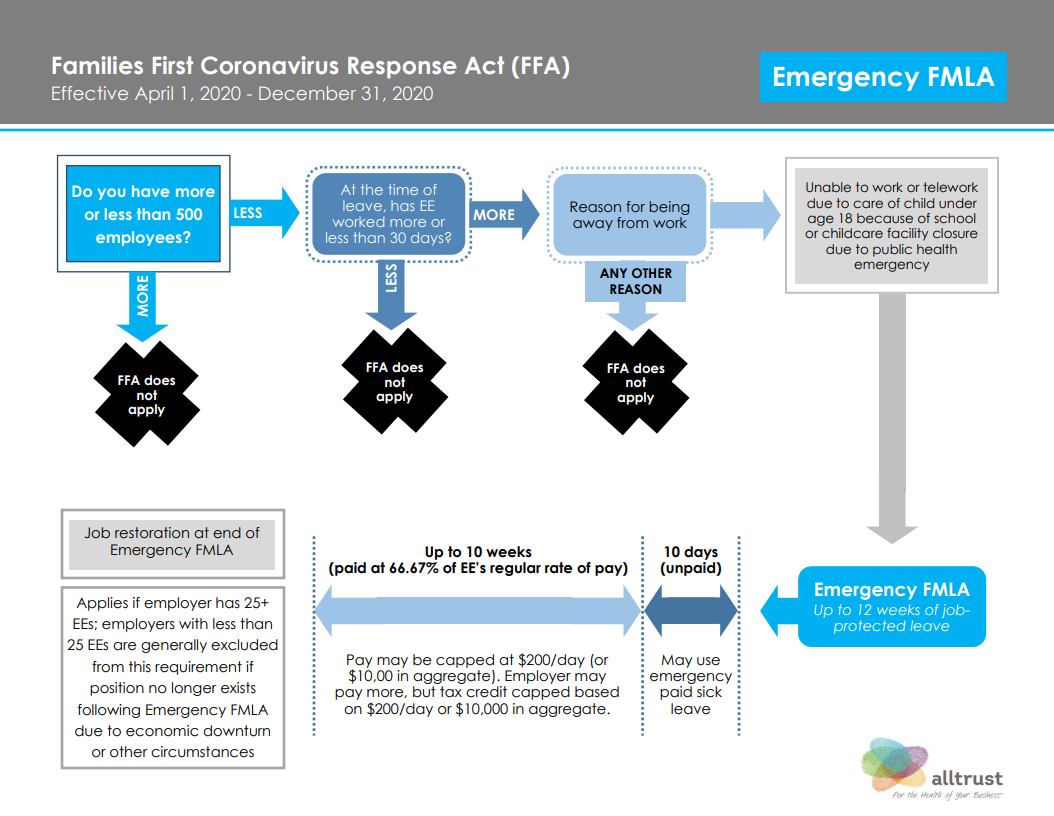

Coverage and Eligibility: This Act expands FMLA and covers employers with fewer than 500 employees. Unlike FMLA, an employee need only have worked for the employer for at least 30 days prior to the leave effective date to be eligible for this leave.

Exclusions: Healthcare providers and emergency providers are excluded from the definition of eligible employees. Employers with fewer than 50 employees are exempt if the leave would jeopardize the sustainability of the business.

Detailed Provisions: The Act allows for an employee to take up to 12 weeks of job-protected leave in order to care for the employee’s child (under 18 years of age) if the child’s school or place of care is closed or the childcare provider is unavailable due to a public health emergency. The first 10 days of Emergency FMLA may be unpaid. During that time, an employee may elect to substitute any accrued paid leave to cover that unpaid period (similar to the short-term disability waiting period). After 10 days have elapsed, the employer, in general, must pay full-time employees at two-thirds the employee’s regular rate of pay for the employee’s regularly scheduled hours. The Act limits pay to $200 per day and $10,000 per employee.

Pay for Part-Time/Irregularly Scheduled Employees: To calculate pay for employees who work a part-time or irregular schedule, employers would calculate the average number of hours worked for the six months prior to the Emergency FMLA. If an employee in this situation has worked at least 30 days but less than six months, employers would use the expected average number of hours that the employee agreed to work upon hire.

Return to Work: Employers with at least 25 employees are required to return any employee who has taken Emergency FMLA to the same or equivalent position with equivalent employment benefits, pay and other terms and conditions of employment (similar to traditional FMLA). Employers with less than 25 employees are excluded if the employee’s position no longer exists. However, the employer must make reasonable attempts to return the employee to an equivalent position and continue those efforts up to a year following the leave.

Tax Credits: The new law does provide for a series of refundable tax credits for employers providing the emergency paid FMLA. Specifically, employers receive a Federal income tax credit for the full term of an employee’s additional leave up to the 12 months permitted under the FMLA emergency expansion. The tax credit is limited to $200 per day and $10,000 per employee so it can be a dollar for dollar credit for employers.

Emergency Paid Sick Leave

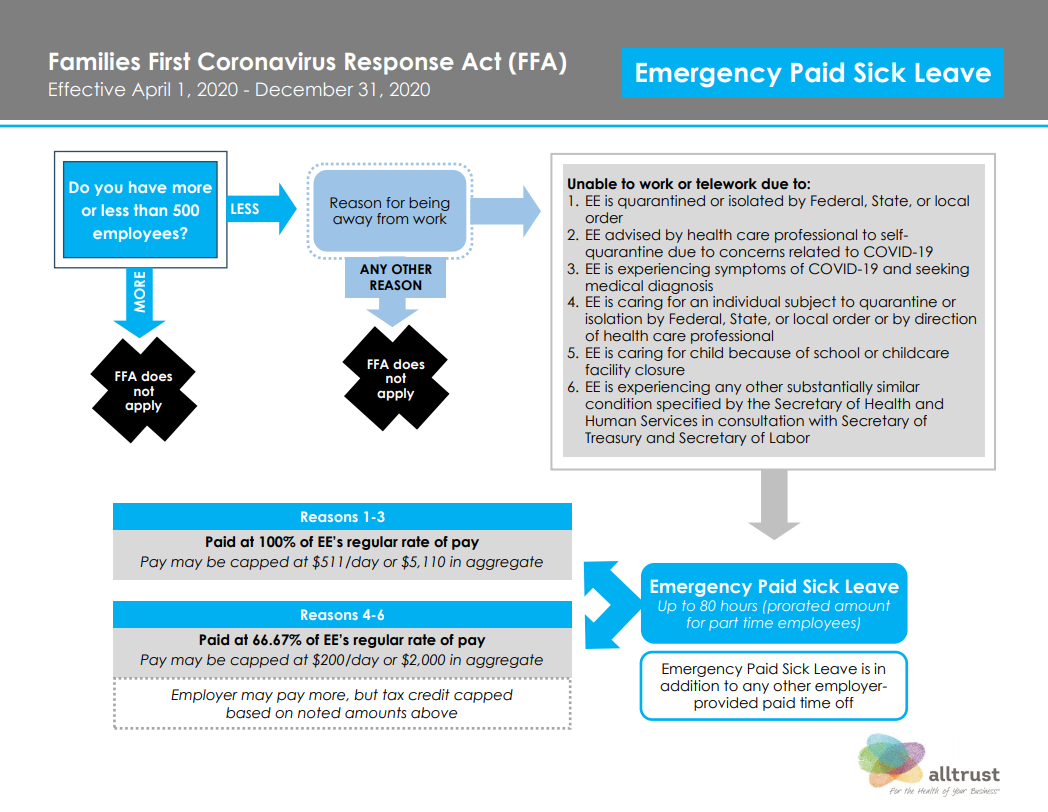

Coverage and Eligibility: This provision covers employers with fewer than 500 employees, as well. All employees working at covered employers are eligible, regardless of length of employment.

Exclusions: Healthcare providers and emergency providers are excluded from the definition of eligible employees. Employers with fewer than 50 employees are exempt if the leave would jeopardize the sustainability of the business.

Detailed Provisions: Eligible employees may collect paid sick leave if they fit under the following categories:

- Subject to a federal, state, or local quarantine or isolation order related to COVID-19;

- Advised by a health care provider to self-quarantine due to COVID-19 concerns;

- Experiencing COVID-19 symptoms and seeking medical diagnosis;

- Caring for an individual (not limited to family) subject to a federal, state, or local quarantine or isolation order or advised by a health care provider to self-quarantine due to COVID-19 concerns;

- Caring for an employee’s child if the child’s school or place of care is closed or the child’s care provider is unavailable due to public health emergency; or

- Experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor.

Eligible employees will receive 80 hours of paid sick leave at the employee’s regular rate (or two-thirds the employee’s regular rate if caring for another individual). Paid sick leave is limited to $511 per day up to $5,110 per employee for self-care ($200 per day up to $2,000 to care for others). A covered employer is required, at the request of the employee, to pay an employee for 80 hours of emergency paid sick leave instead of the initial 10 days of unpaid leave permitted by the Emergency Family and Medical Leave Expansion Act. This paid sick leave is in addition to any paid sick leave currently provided by an employer’s policy. Employers may not require employees to use other types of leave available by law or company policy before using the emergency paid sick leave. An employer may not change its current sick leave policy after enactment of the Act (if the changes prove detrimental to employees).

Pay for Part-Time/Irregularly Scheduled Employees: To calculate pay for employees who work a part-time or irregular schedule, employers would calculate the average number of hours worked for the six months prior to the leave. If an employee in this situation has worked at the employer less than six months, the employee’s pay is based on the average number of hours the employee would normally be scheduled to work over a two-week period.

Tax Credits: The new law does provide for a series of refundable tax credits for employers providing the emergency paid sick leave. Specifically, an employer receives a Federal income tax credit for the first 10 days of an employee’s paid sick leave entitlement under the Emergency Paid Sick Leave provisions. The tax credit is limited to $511 per day (or $200 per day in instances where the employee utilizes the paid sick time off (a) to care for his or her son or daughter or such other individuals under the circumstances permitted under the Paid Sick Leave provisions or (b) because the employee is experiencing “substantially similar conditions”.

In addition to this federal Act, many states are looking to enact and/or expand upon their own paid sick leave and family and medical leave laws. Some of these state laws may be in addition to these new federal requirements.

Coverage for COVID-19 Testing

Applicable Plans: The Act require all health plans – insured and self-funded, large and small – to provide no-cost coverage for diagnostic testing of COVID-19.

Coverage: Health plans and insurance carriers must cover FDA-approved diagnostic testing, including any items or services provided during a visit to a provider, urgent care center, or emergency room. Health plans cannot impose any cost-sharing requirements on these services, nor can plans require prior authorization. Importantly, plans are not required to provide no-cost coverage of COVID-19 treatment.

Impact on HDHPs and HSAs: Pursuant to previously issued guidance by the Internal Revenue Service, a health plan that otherwise meets the requirements of to be a high-deductible health plan (HDHP) will not fail to be an HDHP merely because it provides pre-deductible coverage for COVID-19 testing and treatment. As a result, individuals covered by an HDHP that offers no-cost testing (as required by the Act) or treatment can maintain their eligibility to make and receive contributions to a Health Savings Account (HSA).

Helpful Resources

U. S. Department of Labor (DOL)

Health and Human Services (HHS) Centers for Disease Control and Prevention

This Bulletin is intended only as a summary and general overview of the new Act as written and currently understood. Further clarification may be needed once the Act is brought into practice. If you have any questions, please contact a member of the your dedicated Alltrust Insurance team.