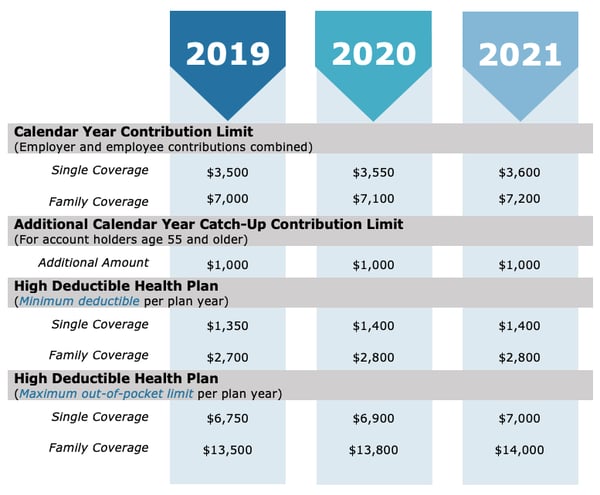

The IRS recently released Revenue Procedure 2020-32 issuing the new inflation-adjusted limits for health savings accounts (HSAs) and qualified high deductible health plans (HDHPs) for 2021. The new limits are as follows:

Key HSA Issues

There are several issues to address in offering a qualified high deductible health plan with an HSA.

Will you arrange for an HSA trustee/custodian for your employees or require employees to locate an HSA trustee/custodian on their own?

While you can select an HSA trustee/custodian for your employees as a service, you cannot prohibit employees from subsequently moving their existing HSA balances to a different HSA trustee/custodian in the future. If the employer limits the employee’s ability to move HSA funds, the HSA could become subject to ERISA.

Have you amended your Section 125 cafeteria plan to permit employees to make pre-tax HSA contributions?

The exclusive way for employees to make HSA contributions on a pre-tax basis is through a Section 125 cafeteria plan. Therefore, it is critical that your plan be amended to provide for this feature.

Will there be employer HSA contributions? If so, what will be the contribution formula?

Any employer HSA contribution should also be addressed in your Section 125 cafeteria plan. There are several different types of formulas. A flat dollar amount for all participants or a flat dollar amount based on coverage tier (e.g., single v. two-person/family) are the most common. It is also permissible to make the employer contribution in the form of a match or based on participation in a wellness program.

Another employer contribution issue is deciding whether to make the contribution in a lump sum at the beginning of the year or prorated over the plan year, or a combination of the two methods. An upfront amount can help the employees with seed money to cover uninsured health expenses incurred at the beginning of the year but cannot be returned to the employer if the employee terminates employment during the year. These are considerations employers may have when making a decision about the timing of any employer HSA contribution.

How will you coordinate the HSA with any medical FSA you offer?

A medical FSA is disqualifying coverage for purposes of HSA eligibility. To address this, some employers discontinue offering a medical FSA to employees enrolling in the HDHP based upon the rationale that the HSA should provide them with a sufficient source of reimbursement for uninsured expenses. Other employers establish what is known as a “limited purpose” medical FSA which only reimburses employees for certain limited purpose expenses such as uninsured dental and vision care. If an employee elects such a limited purpose medical FSA, it will not cause the individual to become HSA ineligible. Also note that if your medical FSA has a 2½ month grace period or a $500 carryover, employees in the medical FSA may also be HSA ineligible in the following plan year. There are strategies to address grace period/carryover issues which you should explore if this is applicable to you.

Are there any special issues to consider if the plan has a telemedicine benefit?

Many employers are offering a telemedicine benefit along with their group health plan, including an HDHP. To provide an incentive for use, some plans allow employees access for no cost. Make sure that you charge participants in the HDHP the full cost of each telemedicine visit until the employee satisfies his or her medical deductible. Otherwise, an employee may jeopardize their HSA eligibility if they have a free telemedicine visit before their deductible is satisfied.

What if the employer makes a mistake with the contributions for an employee’s HSA?

Contributions made to an HSA are non-forfeitable and once a contribution is made, it generally cannot be taken back. However, there are some exceptions to this rule that apply to excess or mistaken contributions.

- If the employer mistakenly believes the individual to be HSA-eligible where he/she was never eligible.

- If the employer mistakenly contributes in excess of the annual maximum contribution limit.

- If the employer contributes the wrong amount or contributes to the wrong account due to a clerical or administrative error.

It is important to note, mistaken continued contributions to an employee who ceases to be HSA-eligible are not recoverable by the employer.

Recent Changes to HDHP/HSA Plans in Response to COVID-19

- Health Plan Coverage for COVID-19 Testing and Treatment (Impact on HSA Eligibility)

- IRS Notice 2020-15

- IRS Provides Temporary Flexibility for Cafeteria Plans, Health FSAs, and DCAPs (No-Cost Coverage and HDHPs)

- Notice 2020-29

- CARES Act-What Employers Need to Know (Employee Benefits Provisions)

- https://www.congress.gov/bill/116th-congress/senate-bill/3548/text

Resources and Other Helpful Links

- Revenue Procedure Provides 2021 Adjusted HSA Amounts:

Revenue Procedure 2020-32 - Health Saving Accounts and Other Tax-favored Health Plans:

IRS Publication 969 - Federal Tax Law for HSAs:

Internal Revenue Code Section 223 - Federal Notice Including Q&As on a Variety of HSA Topics:

IRS Notice 2004-50